Option intrinsic value calculator

This can also be used to simulate the outcomes of prices of the options in case of change in. It is the ethical or philosophic value that an object has in itself or for its own sake as an intrinsic property.

/dotdash_Final_Extrinsic_Value_Curve_Apr_2020-01-010f32375f534dd78b2b8af044b8e65d.jpg)

Extrinsic Value Definition

The GE 30 call option would have an intrinsic value of 480 3480 - 30 480 because the option holder can exercise the option to buy GE shares at 30 then turn around.

. Both intrinsic and extrinsic value are determined by the fill price and the bidask spread. As an equation it looks like. The strike is 47 in this case and Bank of America.

Intrinsic Value EPS x 85 2g x 44. It is the amount call and put prices will change in theory for a corresponding one-point change in implied volatility. On the examples with Microsoft stock we have explored the strike price and intrinsic value of call options and put options.

When an option contract expires the time value would be zero. An object with intrinsic value. Ad How To Trade Options will change how you invest your money - receive it today.

Underlying Price - The underlying symbol price. Using the Graham Formula detailed above and the inputs obtained in steps 1 through 3 you can now calculate a companys intrinsic value. Total Option Premium Intrinsic Value Extrinsic Value.

Create a free account. The described formula is given below. Get Started In Your Future.

V EPS 85 2 g where. Ad This dynamic tool forecasts the expected range of the SP 500 Index over the next 30 days. The intrinsic value is the difference between the underlyings price and the strike price or the in-the-money portion of the options premium.

The constant represents the. The extrinsic value is the portion of the option that is subject to theta decay. So in theory the option holder could exercise the option to buy XYZ.

A call option for XYZ with a strike price of 40 would have an intrinsic value of 800 48 40 8. Ad This dynamic tool forecasts the expected range of the SP 500 Index over the next 30 days. Ad Since 2005 The Slope of Hope Has Been The Go-To Site For Traders Who Love Charts.

Ad Build Your Future With A Firm That Has 85 Years Of Investing Experience. 5 Accredited Valuation Methods and PDF Report. Above all how to apply the idea of intrinsic value of option in reality and how it impacts the market price.

Option Value Intrinsic Value Time Value. Find A One-Stop Option That Fits Your Investment Strategy. Ad Branch out from FX and Equities Get a Free Guide to Trading Futures.

A put options intrinsic value is the amount by which the puts strike price is higher than the current market price of the underlying stock. Therefore in this calculator we will use a simple formula proposed by Benjamin Graham to determine the intrinsic value of a stock. Strike price and intrinsic value.

Highest Strike - The highest strike at the top of the table of. The intrinsic value calculator asx helps the invested to understand what it would be if the investor exercises the option at the current point in time. To sum up and make it look a bit more.

Ad Futures Trading Made Easy. Intrinsic Value options Stock Price Strike Price Number of Options. Intrinsic Value 2070 x 85.

At this point the option value is equal to the intrinsic value. Use this tool to help calculate the extrinsic value on an option youre holding. Say American Airlines AAL is trading for 35 a share.

The intrinsic value is the actual value of a company or an asset based on an underlying perception of its true value including all aspects of the business in. Vega does not have any effect on the intrinsic value of options. Take A Free 14-Day Trial Now.

Intrinsic value is an ethical and philosophic property. Join 21800 value investors using Alpha Spread. Come check out the most powerful tools for traders and learn from the community.

This tool can be used by traders while trading index options Nifty options or stock options. You own four call options that entitle you to. Meanwhile the time value tells the investor.

Input values to create a table of expiration prices for Calls and Puts. The companys last 12-month earnings per shareu0006. Ad Learn How To Trade Options in a volatile marketplace.

Or see our plans pricing. Smart Options Strategies shows a safer way to trade options on a shoestring budget. Ad No Financial Knowledge Required.

Let us also understand this intrinsic value versus market value debate. Specifically the intrinsic value of a call option is.

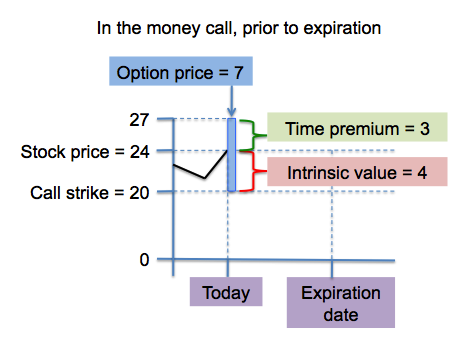

Time Premium In Options

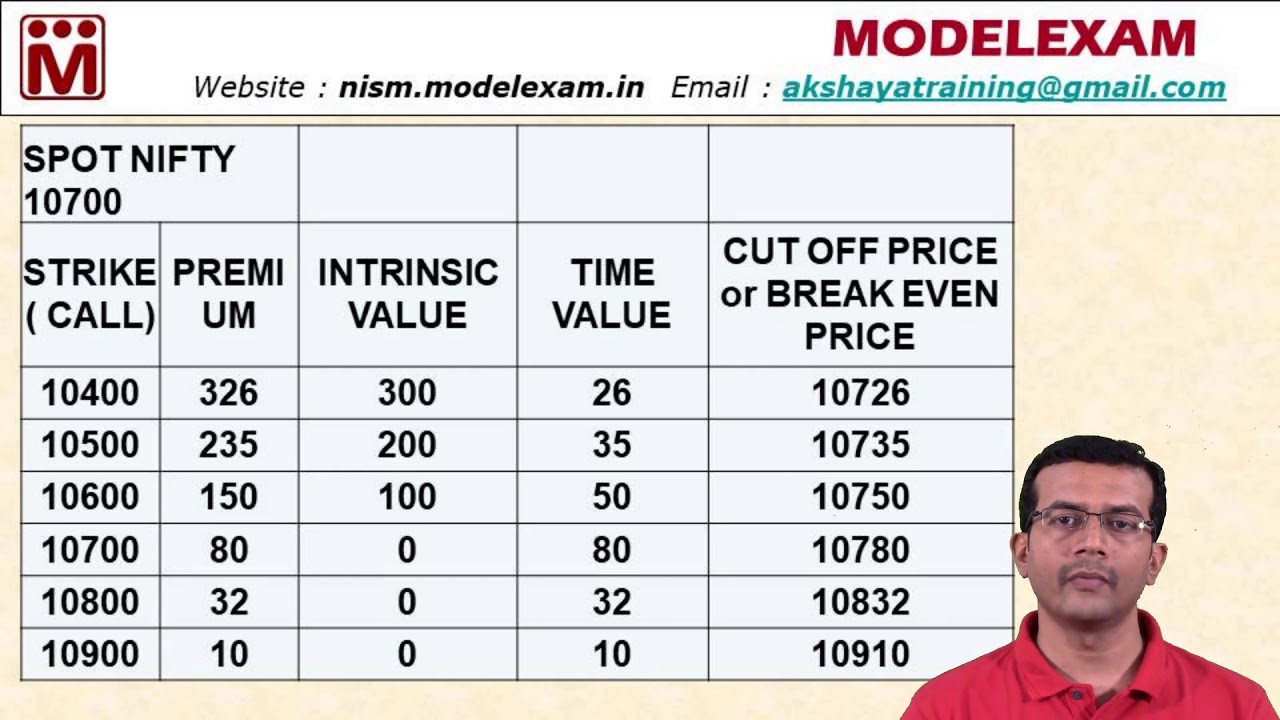

How To Calculate Time Value Intrinsic Value Cut Off Price Of An Option Youtube

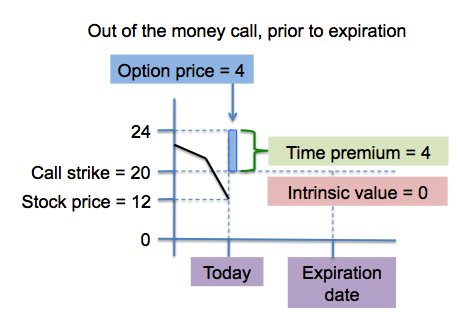

What Is The Intrinsic Value Of A Call Option Quora

What Is The Intrinsic Value Of A Call Option Quora

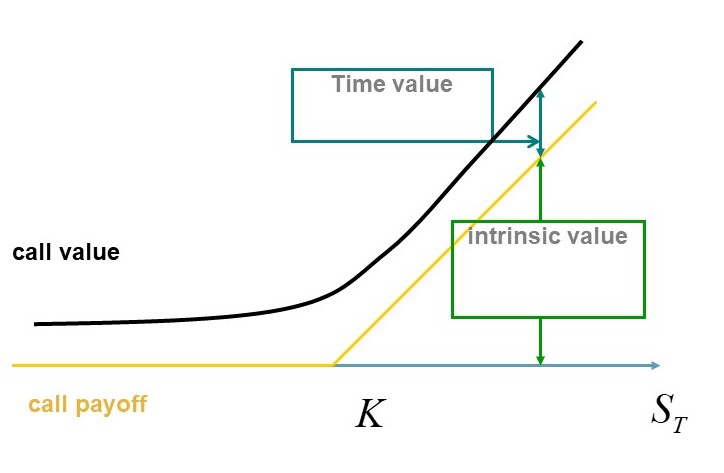

The Options Industry Council Oic Options Pricing

/dotdash_Final_Understanding_How_Options_Are_Priced_Aug_2020-01-c5699fc51f48461fa3413e4e97049857.jpg)

Option Pricing Models Formula Calculation

Option Pricing The Intrinsic And Time Values Of Options Explained

Time Premium In Options

What Is Intrinsic Value In Option Derivative Market Quora

The Ultimate Guide To Option Moneyness Itm Otm Atm

What Is The Intrinsic Value In Option Trading Quora

Options Time Value Free Excel Calculator Options Time Intrinsic Value Youtube

How To Calculate Time Value Intrinsic Value Premium Of An Option Youtube

Newsletter July 2019 Long Call Option With Negative Time Value Mathfinance

/dotdash_Final_Understanding_How_Options_Are_Priced_Aug_2020-01-c5699fc51f48461fa3413e4e97049857.jpg)

Option Pricing Models Formula Calculation

:max_bytes(150000):strip_icc()/dotdash_Final_Understanding_How_Options_Are_Priced_Aug_2020-02-ba51015e895b4ba7abbd7632e1908360.jpg)

Option Pricing Models Formula Calculation

/dotdash_Final_Understanding_How_Options_Are_Priced_Aug_2020-01-c5699fc51f48461fa3413e4e97049857.jpg)

Option Pricing Models Formula Calculation